Koscom NAV and iNAV

The net asset value of an ETF is computed by dividing the total value of the ETF’s underlying assets by the number of outstanding shares:

\[\text{nav} = {\text{cash} + \sum \text{assets} \over \text{number of oustanding shares}}\]The calculation is quite easy but getting the right data can be a hassle. In this post, we go over how to calculate the net asset value of

Data and parameters

We will calculate the net asset value of KODEX KOSPI200 ETF (KR7069500007) that tracks KOSPI200 index and KODEX KOSDAQ150 ETF (KR7229200001) that tracks KOSDAQ150 index on May 26, 2023.

In our database, we have the following tables (and interface id):

- KrxETFNAV (BV03S): contains ETF net asset value messages that is sent by Koscom.

- KrxETFPDF (F803S): contains the portfolio deposit file (or portfolio composition file)

- KrxStockBatchData (IFMSBTD0001): contains stock batch data messages where each message contains information of a security traded at KRX

- KrxStockMarketdepth (IFMSRPD0002): contains stock marketdepth data, we are only interested in best ask and best bid price/quantity.

ETF PDF data

ETF’s portfolio deposit file message get disseminated in the morning before the market opens (it is sent twice, one at 6:00 and the next at 7:00). We are interested in KODEX KOSDAQ150 ETF’s pdf which we can find sending the following query to our clickhouse database:

SELECT DISTINCT ON (component_isin)

component_isin

, securities_per_1_cu_or_contract_units_or_korean_won_cash

, par_value_or_initial_cash_amount

, valuation_amount

, toTimeZone(system_datetime, 'Asia/Seoul') as system_datetime

FROM default.KrxETFPDF

WHERE

isin='KR7229200001'

AND toDate(system_datetime, 'Asia/Seoul')='2023-05-26'

ORDER BY component_isin

This query will return a table that looks like the following:

component_isin securities_per_1_cu_or_contract_units_or_korean_won_cash par_value_or_initial_cash_amount valuation_amount system_datetime

0 KR7000250001 7300.0 0.0 4577100.0 2023-05-26 07:07:11.751923396+09:00

1 KR7003100005 1400.0 0.0 367500.0 2023-05-26 07:07:11.782741794+09:00

2 KR7003380003 20400.0 0.0 1750320.0 2023-05-26 06:27:11.556796744+09:00

3 KR7005290002 18100.0 0.0 6452650.0 2023-05-26 06:27:11.587258894+09:00

4 KR7006730006 14200.0 0.0 1079200.0 2023-05-26 06:27:11.617790990+09:00

5 KR7007390008 26500.0 0.0 2806350.0 2023-05-26 06:27:11.648251013+09:00

6 KR7015750003 24800.0 0.0 2480000.0 2023-05-26 06:27:11.678772217+09:00

7 KR7016790008 11500.0 0.0 3588000.0 2023-05-26 07:07:11.966518570+09:00

8 KR7022100002 26800.0 0.0 3130240.0 2023-05-26 07:07:11.997238082+09:00

9 KR7023410004 23100.0 0.0 820050.0 2023-05-26 07:07:12.027744952+09:00

10 KR7025900002 2300.0 0.0 1104000.0 2023-05-26 06:27:11.800727598+09:00

11 KR7025980004 30900.0 0.0 1918890.0 2023-05-26 07:07:12.088699514+09:00

12 KR7027360007 23900.0 0.0 579575.0 2023-05-26 06:27:11.862013942+09:00

13 KR7028300002 57700.0 0.0 20598900.0 2023-05-26 06:27:11.892536047+09:00

14 KR7029960002 11000.0 0.0 811800.0 2023-05-26 06:27:11.923032848+09:00

15 KR7030190003 17900.0 0.0 1909930.0 2023-05-26 06:27:11.953537584+09:00

...

On May 26 2023, there are 152 components in the KODEX KOSDAQ150 ETF. To compute the net asset value of the ETF, we sum the valuation amount column and divide it by the creation unit. For KODEX KOSDAQ150 ETF, the creation unit is 50000:

nav = np.sum(df["valuation_amount"]) / 50000 # 12793.0077

The resulting nav matches the official previous day nav disseminated by Koscom. We can check the correctness of the valuation amount by taking the previous closing price of each stock and multiplying it to the number securities per 1 cu column value:

etf_pdf = EtfPdf(etf_isin, date_str, etf_cu, tz)

etf_batchdata = StockBatchData([etf_isin], date_str, tz)

etf_intraday_nav = EtfIntradayNav(etf_isin, date_str, tz)

assert etf_pdf.nav - etf_intraday_nav.prev_day_nav < 1e-2, f"diff: {etf_pdf.nav - etf_intraday_nav.prev_day_nav}"

The class functions EtfPdf, StockBatchData, EtfIntradayNav are provided in the attached file. When running the above code, we see that all the valuation amounts match our calculated valuation amounts.

Marketdepth data for component stocks

Koscom disseminates nav data of every ETF every second, and more importantly, the first nav message is sent at ‘09:00:10’. For HFT firms, this is a potential arbitrage opportunity. We can compute intraday NAV of an ETF from individual stock quotes. In order to do that, we need to get the marketdepth data of all component stocks and update our nav:

WITH stock_marketdepth AS (

SELECT

isin,

l1askprice,

l1asksize,

l1bidprice,

l1bidsize,

(l1askprice + l1bidprice) / 2 AS midprice,

(l1askprice * l1bidsize + l1bidprice * l1asksize) / (l1asksize + l1bidsize)

AS weighted_midprice,

toDate(system_datetime, 'Asia/Seoul') as date,

toTimeZone(system_datetime, 'Asia/Seoul') as system_datetime,

'KR7229200001' as etf_isin

FROM default.KrxStockMarketdepth

WHERE

toDate(system_datetime, 'Asia/Seoul')='2023-05-26'

AND

toTime(system_datetime, 'Asia/Seoul') BETWEEN

toTime(parseDateTimeBestEffort('09:00:01.0', 'Asia/Seoul'), 'Asia/Seoul')

AND

toTime(parseDateTimeBestEffort('15:19:59.0', 'Asia/Seoul'), 'Asia/Seoul')

AND isin in ({",".join([f"'{isin}'" for isin in isins])})

ORDER BY system_datetime

)

, nav AS (

SELECT

isin

, previous_day_nav / 100 as prev_day_nav

, intraday_final_nav / 100 as intraday_final_nav

, toTimeZone(system_datetime, 'Asia/Seoul') as system_datetime

FROM default.KrxETFNAV

WHERE isin='KR7229200001'

AND toDate(system_datetime, 'Asia/Seoul')='2023-05-26'

ORDER BY system_datetime ASC

)

SELECT

stock_marketdepth.*

, nav.prev_day_nav

, nav.intraday_final_nav

FROM stock_marketdepth

ASOF LEFT JOIN nav

ON stock_marketdepth.etf_isin = nav.isin

AND stock_marketdepth.system_datetime >= nav.system_datetime

ORDER BY system_datetime

Note that we used python to run this query since it is cumbersome to write down all 152 isins that are in KODEX KOSDAQ150 ETF. The result of the query will look something like this:

isin l1askprice l1asksize l1bidprice l1bidsize midprice weighted_midprice date system_datetime etf_isin prev_day_nav intraday_final_nav

10000 KR7041510009 104100.0 58 104000.0 28 104050.0 104032.558140 2023-05-26 2023-05-26 09:01:01.829710847+09:00 KR7229200001 12793.01 12844.34

10001 KR7060720000 20550.0 935 20500.0 100 20525.0 20504.830918 2023-05-26 2023-05-26 09:01:01.841332664+09:00 KR7229200001 12793.01 12844.34

10002 KR7052020005 19270.0 193 19260.0 78 19265.0 19262.878229 2023-05-26 2023-05-26 09:01:01.855721867+09:00 KR7229200001 12793.01 12844.34

10003 KR7067310003 17310.0 530 17300.0 10406 17305.0 17309.515362 2023-05-26 2023-05-26 09:01:01.862351680+09:00 KR7229200001 12793.01 12844.34

10004 KR7067630004 10920.0 30 10890.0 95 10905.0 10912.800000 2023-05-26 2023-05-26 09:01:01.864752235+09:00 KR7229200001 12793.01 12844.34

10005 KR7058470006 126700.0 573 126600.0 321 126650.0 126635.906040 2023-05-26 2023-05-26 09:01:01.874548800+09:00 KR7229200001 12793.01 12844.34

10006 KR7074600008 26600.0 662 26500.0 925 26550.0 26558.286074 2023-05-26 2023-05-26 09:01:01.876554644+09:00 KR7229200001 12793.01 12844.34

10007 KR7078340007 67900.0 200 67800.0 20 67850.0 67809.090909 2023-05-26 2023-05-26 09:01:01.881207917+09:00 KR7229200001 12793.01 12844.34

10008 KR7061970000 8030.0 902 8020.0 30 8025.0 8020.321888 2023-05-26 2023-05-26 09:01:01.884060829+09:00 KR7229200001 12793.01 12844.34

10009 KR7064260003 4285.0 161 4275.0 252 4280.0 4281.101695 2023-05-26 2023-05-26 09:01:01.886363998+09:00 KR7229200001 12793.01 12844.34

Now we are ready to calculate intraday nav.

Calculating intraday nav

To compute inav, we update the price of the stock whenever a message that contains an orderbook data of ETF’s component stock comes in. Using the query result from above, we can write the following python code:

tz = "Asia/Seoul"

beg_date_pd = pd.to_datetime("2023-05-26").tz_localize(tz).date()

end_date_pd = pd.to_datetime("2023-05-26").tz_localize(tz).date()

beg_time = "09:00:01.0"

end_time = "15:19:59.0"

etf_isin = 'KR7229200001' # kosdaq150, 'KR7069500007' for kospi200

etf_cu = 50000

for date in pd.date_range(beg_date_pd, end_date_pd):

date_str = date.strftime("%Y-%m-%d")

print(date_str)

# check if the date is a trading date, if not continue

if not is_trading_date(date_str):

continue

# get pdf data

etf_pdf = EtfPdf(etf_isin, date_str, etf_cu, tz)

etf_batchdata = StockBatchData([etf_isin], date_str, tz)

etf_intraday_nav = EtfIntradayNav(etf_isin, date_str, tz)

assert etf_pdf.nav - etf_intraday_nav.prev_day_nav < 1e-2, f"diff: {etf_pdf.nav - etf_intraday_nav.prev_day_nav}"

component_marketdepth = MarketdepthWithNavData(

etf_pdf.component_isins,

etf_isin,

date_str,

beg_time, end_time, tz)

inav = []

for k, row in enumerate(component_marketdepth):

koscom_nav = row["intraday_final_nav"] if row["intraday_final_nav"] > 0 else etf_intraday_nav.prev_day_nav

etf_pdf.update_state(

row["isin"],

row["weighted_midprice"],

koscom_nav,

row["system_datetime"]

)

inav.append((

etf_pdf.updated_datetime,

etf_pdf.nav,

etf_pdf.koscom_nav,

etf_pdf.nav - etf_pdf.koscom_nav))

df = pd.DataFrame(inav, columns=["updated_datetime", "nav", "koscom_nav", "diff"])

df.plot(

x="updated_datetime",

y=["nav", "koscom_nav"],

figsize=(30, 10),

grid=True

)

df.plot(

x="updated_datetime",

y=["diff"],

figsize=(30, 10),

grid=True

)

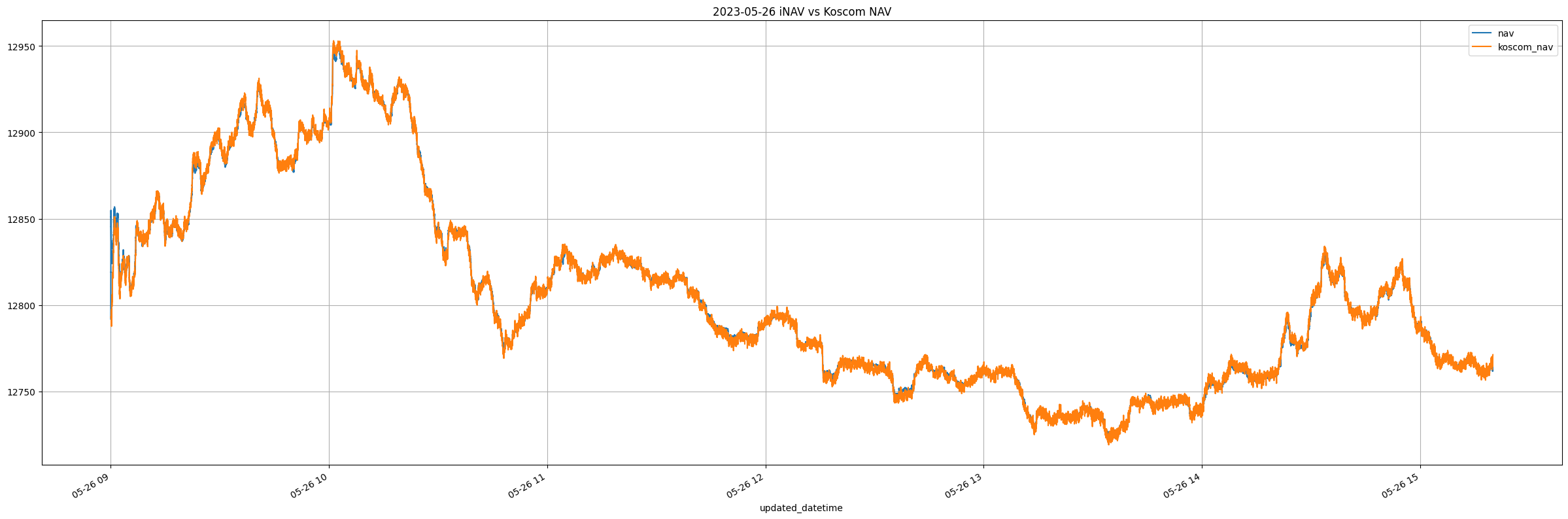

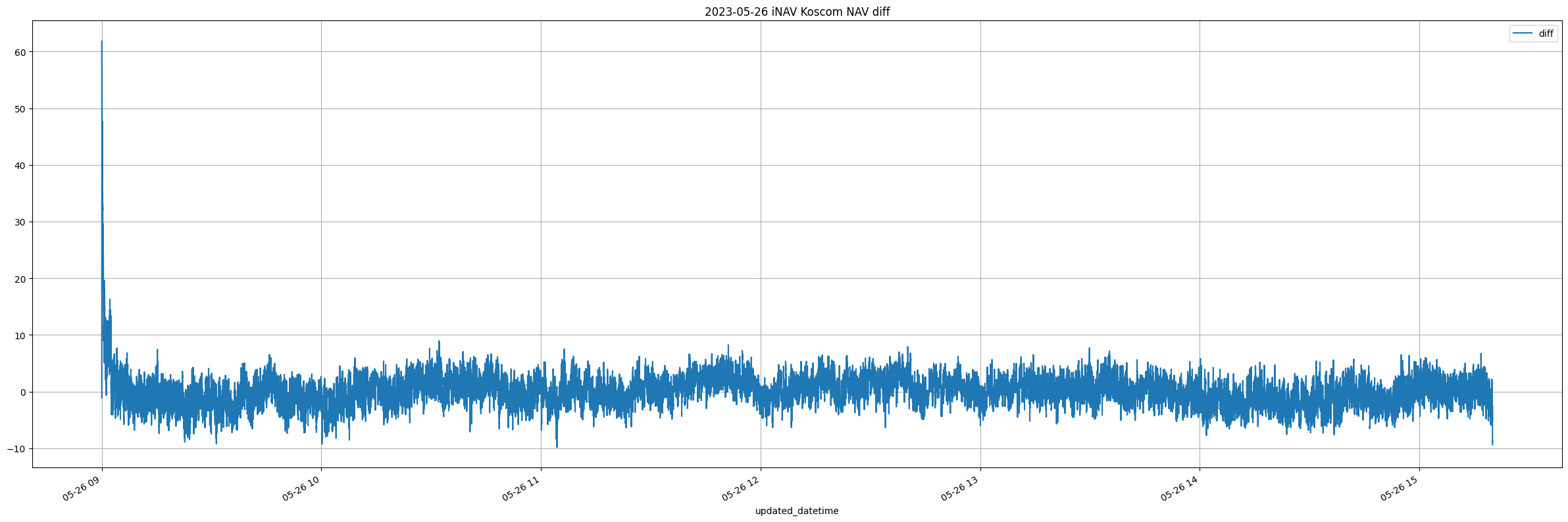

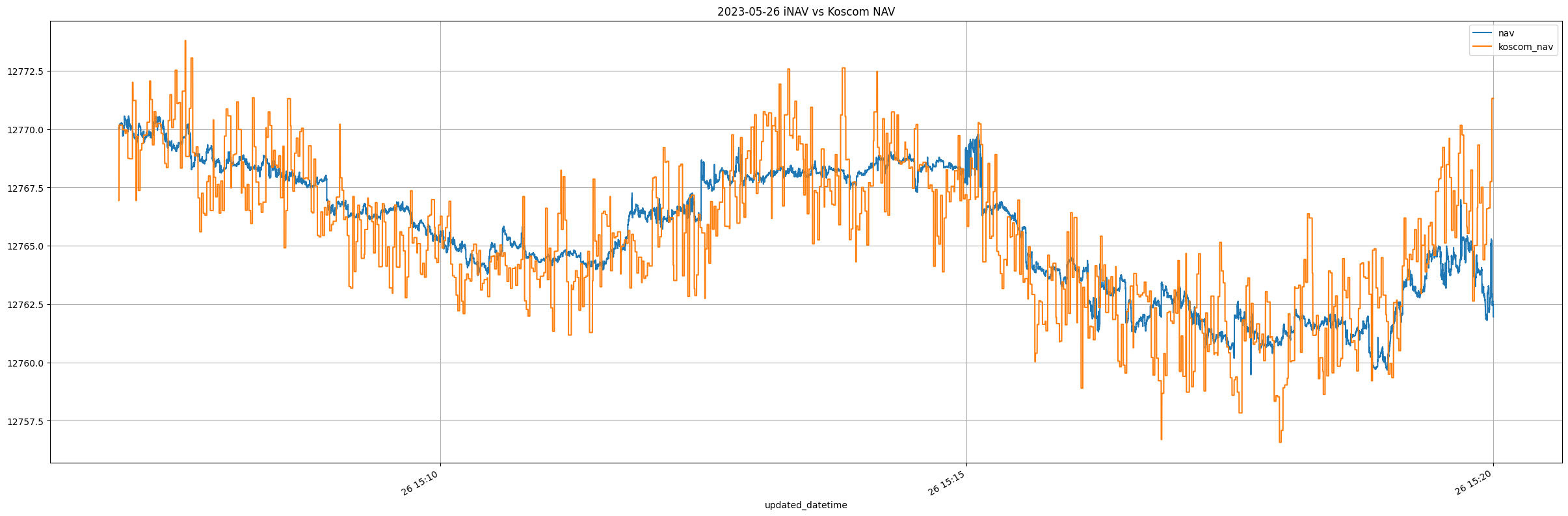

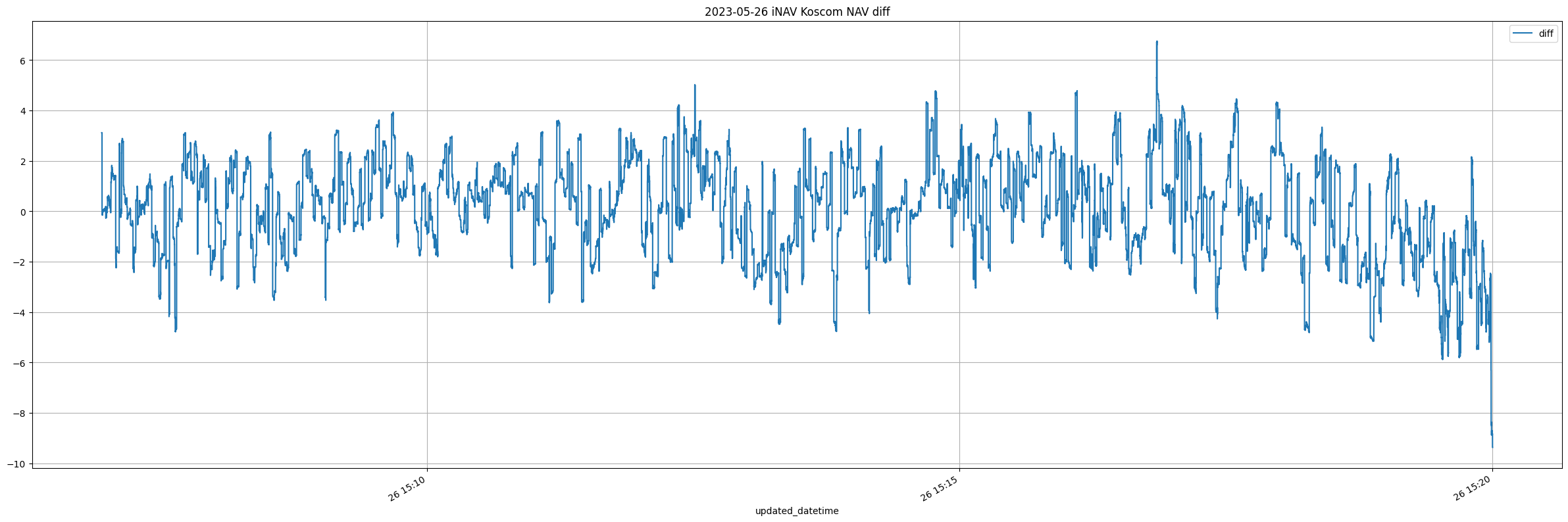

The resulting plots are shown below:

The plot indicates that divergence in nav values occur mostly in the morning. Throughout the day, the nav values converge pretty well. Let’s look at iNav and Koscom NAV more closely in the morning:

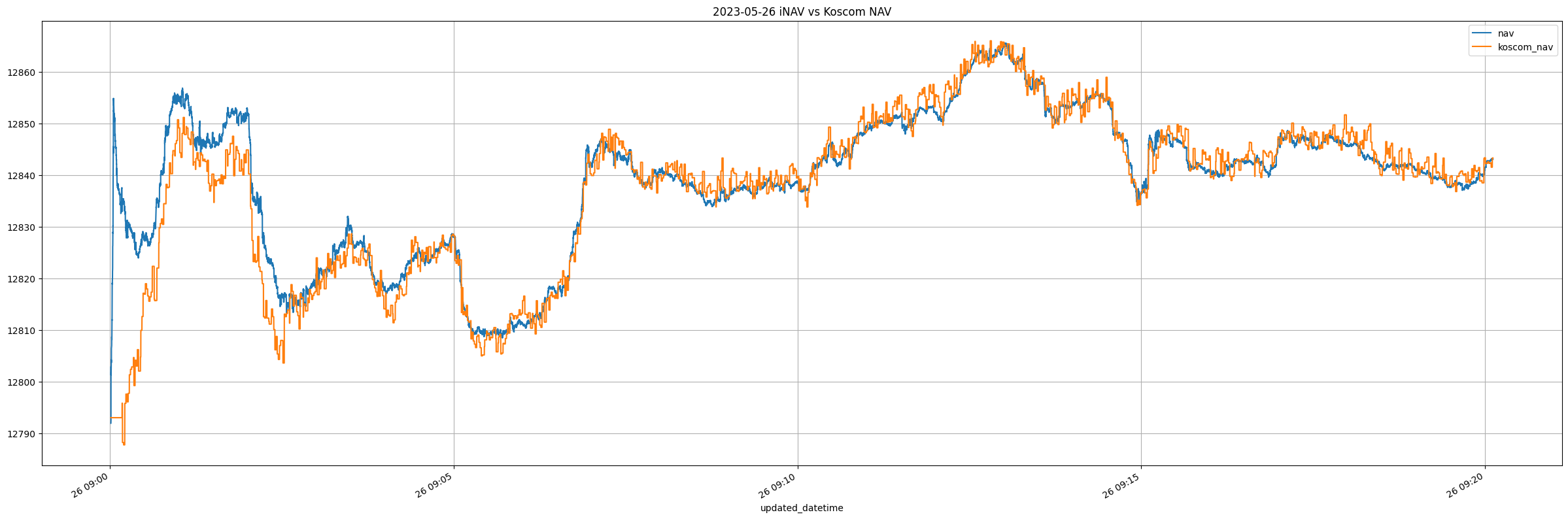

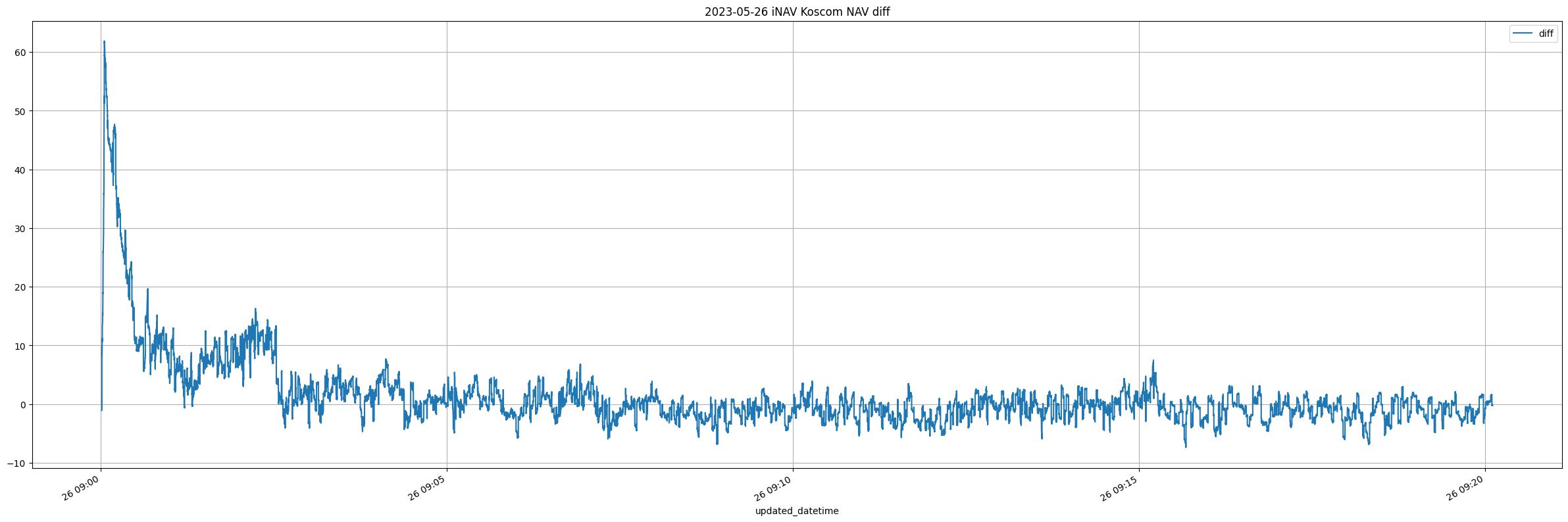

We see that in the first 5 minutes of trading hours, the nav value from Koscom has a hard time keeping track of our inav. However, after 09:05:00.0, things start to settle and we see that inav and koscom nav values converge nicely.

Above are inav and koscom nav before market close.

Leave a comment